In light of the collapse of Silicon Valley Bank which has been widely attributed to the absence of bank risk management, we had a theory that Bank Board expertise in general might be lacking. We decided to look at Bank Board Governance for evidence of bank risk management at banks between $1 and $10 billion in assets (*For our methodology and parameters, please refer to “About the Board Talent Analysis” below), assuming that larger banks likely had this expertise (there may be a second analysis needed for banks $10-$100b). Additionally, we decided to look for expertise in other ‘hot’ areas such as Cyber, IT, and Regulatory experience. The results of our research were striking.

Discover the latest insights in Travillian Next’s Bank Board Insights Series IV, where we uncover critical findings highlighting talent gaps within boards in crucial areas of board governance. Additionally, we present an essential best-in-class approach to enhance and elevate board governance practices.

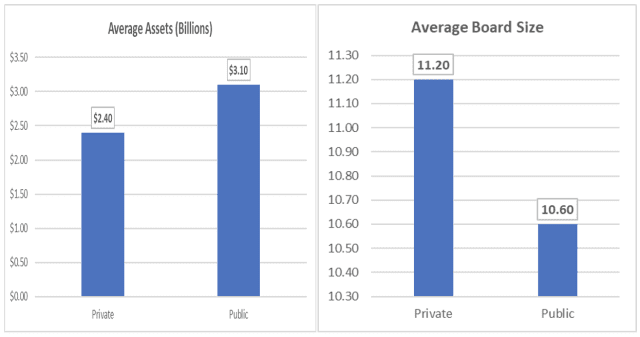

Bank Board Talent Analysis Comprised of Public and Private Banks ($1 Billion to $10 Billion in Assets) with Average Assets and Size of the Board Below:

Average Assets of Banks and Size of Boards

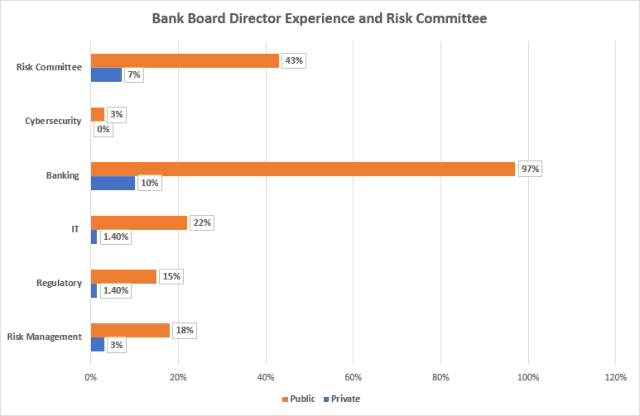

Bank Boards Lack Key Expertise in Risk Management, Regulatory, IT and Cybersecurity as Noted in the Chart Below.

Despite an overall larger board size for Private Banks vs Public Banks, Private Banks have larger gaps in board level expertise in key areas: Risk Management, Regulatory, IT and Cybersecurity.

With the exception of Banking experience which stood at 97%, Public Boards also lack expertise in these areas with only 18% of the Public Banks having Risk Management talent on the board. Of the public banks, 43% of the banks had Risk Committees. Although significantly better than the Private Banks, 43% is still less than half.

As seen below, Regulatory expertise which is crucial in an operating environment that is becoming increasingly complex, indicates 15% for Public Banks vs 1.4% for the Private Banks.

With the digitization of banking, Cybersecurity and IT expertise are worth the investment. Cyber concerns are more pronounced than ever but board expertise in these areas is low at 3% for Public Banks vs 0% for Private Banks while IT board expertise reveals 22% for Public Banks vs 1.4% for the Private Banks.

Other Key Findings of Bank Board Analysis

We found that Private Banks were not as transparent about Board expertise as Public Banks. Of the private banks, less than half had information about their Boards on their websites.

We noted some Bank’s doing an admirable job of not only describing their Board members experiences and expertise, but actually stating why the Board member is a good fit. Ex: ‘board member x’s experience in risk management and IT make them qualified to be on the Board.’

Additionally, we found that predominantly, where banks do not have a separate risk committee the public boards have risk oversight as part of their enterprise risk management program which includes reports from executive management.

Recommendations

- Banks should be transparent about their Board membership and their governance.

- Banks should work to enhance the expertise resident in their Board membership by ensuring\adding Directors with banking risk management expertise, IT expertise, Cyber expertise and if possible Regulatory expertise.

In summary, customers and investors should have insight into the Boards of their banks and that insight should be more than just the Board member’s name. It should include their expertise.

Best-In-Class Board Governance in Navigating Today’s Banking Climate

Transparency and Expertise in Board membership Essential components of good governance in banking. Banks that prioritize these aspects are more likely to build trust with their stakeholders and effectively manage risks and challenges in the dynamic financial landscape.

Digital Age Expertise Banking risk management, IT expertise, and cyber expertise are increasingly important in the digital age, given the rising threat of cyberattacks and the complexity of financial systems. As technology plays a significant role in banking operations, having directors with IT and cybersecurity expertise is essential for safeguarding customer data, preventing fraud, and ensuring the bank’s systems are secure with appropriate preventive measures.

Regulatory Expertise Vital for ensuring compliance with ever-evolving financial regulations. Board expertise is valuable for understanding and navigating the complex regulatory environment in which banks operate to become better stewards of the organization.

Board Talent A board with diverse expertise is better equipped to make informed decisions that support the long-term viability and sustainability of the bank. Given the pivotal role that boards play as strategic assets to organizations, it is imperative for bank boards to direct their attention not solely toward the issues at hand, but predominantly towards cultivating a pipeline of Board talent and expertise.

About the Board Talent Analysis

*Our approach: We used the list of public US banks from S&P Capital IQ. The list was 584 banks. The list was filtered down to banks with asset size $1-$10b resulting in 319 banks. Our hypothesis was that 10% of banks would have banking risk management expertise on their boards. To prove this thesis to 95% confidence, a random sample of 101 were analyzed. The same approach was taken for private banks. From 3/31/23 call report data, the list was filtered down to asset size $1-$10b resulting in 835 banks. Our hypothesis was that 5% of banks would have banking risk management expertise on their boards. To prove this thesis to 95% confidence, a random sample of 73 private banks were analyzed. Bank websites were then reviewed for information on Board Governance, and Board membership. For public banks, Board member insights were sourced from S&P Capital IQ, Proxy, bank websites and investor relations were contacted as needed.

By Indra Elangovan, Head of Strategic Advisory at Travillian and Peter Moenickheim, CERP, Prior CRO, Interim CRO, Fractional CRO, and Board Advisor

More Information

For more information please e-mail Indra Elangovan directly at ielangovan@travilliangroup.com or to read the rest of the Travillian Next Bank Board Insights series, please click one of the links below:

Part I: A Thriving Bank Requires a Thriving Board – Let’s Make it Happen!

Part II: Risk Governance with Contributing Guest Michele Wucker

Part III: How to Dress For SUCCESSion

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Indra Elangovan, Head of Strategic Advisory

(443) 844-2798 | ielangovan@travillaingroup.com |